This post is for vendor reference.

We get it, the Federal Government and Provincial Governments in Canada have stepped in and are enforcing billable services provided by US based companies to charge Canadians PST & GST.

This has left a lot of organizations scrambling to comply.

However, every day, we spend time trying to get vendors to acknowledge that First Nations in Canada do not have a GST/HST Registration Number for tax exemption.

As we have yet to encounter a vendor based outside of Canada that is familiar with tax-exemption as it applies to First Nations (Indian Bands), and we are very tired of sending vendors the necessary information, we’ve put the information together in this post.

What vendors need to know about taxes in Canada 🇨🇦

- The Canada Revenue Agency (CRA) administers tax laws for the Government of Canada and for most provinces and territories.

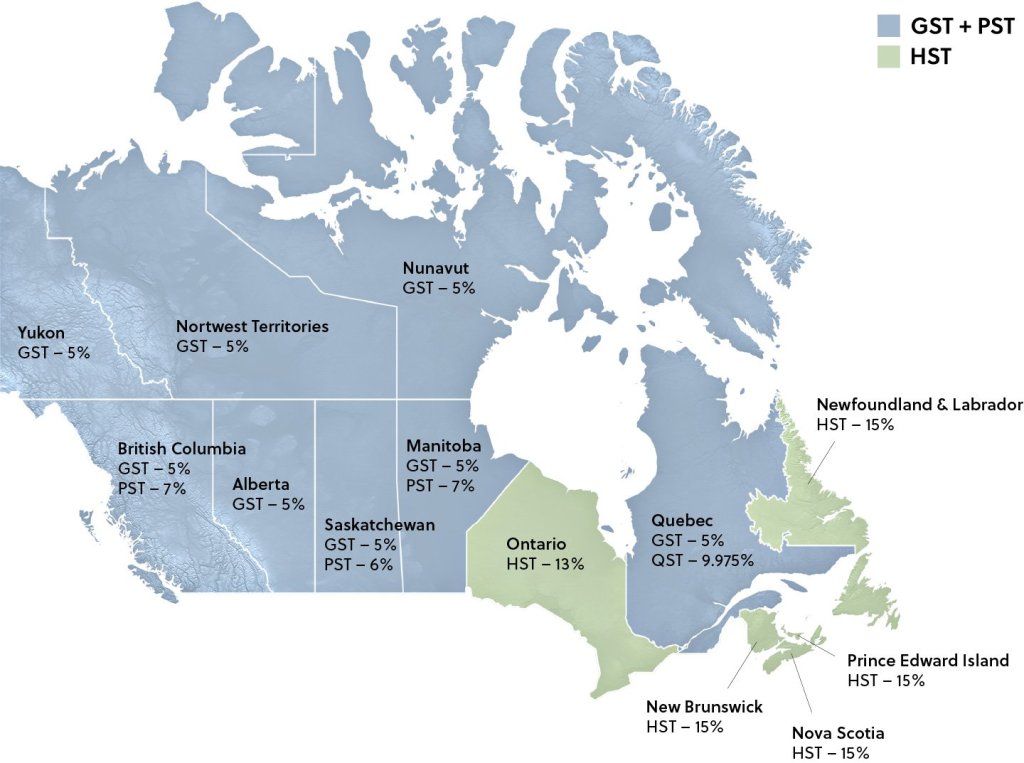

- GST/HST is goods and services tax/harmonized sales tax. This is Federal (across Canada).

- PST is provincial sales tax. This is different for each Province.

GST / HST 💰

Important reference links

What vendors need to know

- First Nations (Indian Bands) and Indigenous People (Status Indians) are exempt from GST under section 87 of the Indian Act.

Required Documentation

- If the sale is made to a Status Indian – You need to record on the invoice or other sales document an Indian’s 10-digit registry number or their band name, which is on the card.

- If the sale is made to an Indian Band – the band must provide an original certificate stating any of the following information:

- that the property is being acquired by an Indian band or an unincorporated band-empowered entity

- in the case of an incorporated band-empowered entity, that the property is being acquired for band management activities or for real property on a reserve

- that the service is being acquired for band management activities or for real property on a reserve

For sales made to an Indian Band the certificate should be similar in wording to the following:

This is to certify that the property or service being acquired by [Insert the name of band or band-empowered entity] is for band management activities (if applicable) or for real property on the reserve. This supply will not be subject to the goods and services tax/harmonized sales tax (GST/HST) or provincial sales tax (PST).

Signature of Authorized Officer

Date

Title of Signing Officer

Sales over the telephone, Internet and other electronic means

Vendors who make sales to Indians, Indian bands or band-empowered entities over the telephone or electronically must also maintain documentary evidence to show that the sale is relieved of tax. Since Indians cannot show their original status card or TCRD, and Indian bands and band-empowered entities cannot provide appropriate certification, when they make a purchase over the telephone or electronically, the CRA has taken the position that, to support their entitlement for tax relief, purchasers may subsequently provide a photocopy of their status card or TCRD (for Indians) or certification (for Indian bands or band-empowered entities) by mail or electronically (for example, over the Internet or by facsimile).

For specific details on what information must be kept for sales made over the telephone or electronically, refer to GST/HST Info Sheet GI-127, Documentary Evidence when Making Tax-Relieved Sales to Indians and Indian Bands over the Telephone, Internet or Other Electronic Means.

PST 💰

Important reference links

- The province of British Columbia – https://www2.gov.bc.ca/assets/gov/taxes/sales-taxes/publications/pst-314-exemptions-first-nations.pdf

- The province of Manitoba –https://www.gov.mb.ca/finance/taxation/pubs/bulletins/taxexemption.pdf

What vendors need to know

- First Nations (Indian Bands) and Indigenous People (Indians) are also exempt from PST when GST exemption applies.

Exemption for Software

Software purchased by a First Nations individual or band is exempt from PST if the software is purchased for use on or with an electronic device that is owned or leased by the First Nations individual or band and is ordinarily situated on First Nations land.

Telecommunication Services

Telecommunication services purchased by a First Nations individual or band are exempt from PST if they are purchased for use on or with an electronic device that is owned or leased by the First Nations individual or band and is ordinarily situated on First Nations land.

Required Documentation

The same documentation required for GST exemption applies to PST exemption.

Thanks for reading.